Money Supply

- The total stock of money in circulation among the public at a particular point in time is called money supply or supply of money.

- It is to be noted the term ‘public’ refers to households, firms, local authorities, companies, etc, and does not include the government and banks.

Components

- Currency Notes and Coins (CU)

- Demand Deposits such as Saving Bank Deposits (DD) – These are those deposits that can be withdrawn on demand from banks.

- Other Deposits such as Time Deposits/Term Deposits/Fixed Deposits – These are those deposits that can be withdrawn only after a specific time.

- Money held in Post Office Saving Accounts.

- Deposits of Banks in other Banks/RBI (except CRR).

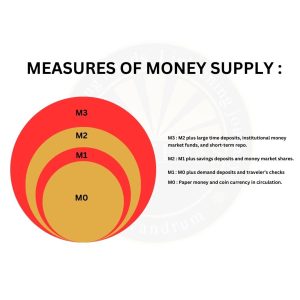

Measures of Money Supply

- Money Supply Measures refer to the tools used to measure the supply of money in an economy.

- M0 (Reserve Money) – M0 is the sum of Currency in Circulation Bankers’ Deposits with RBI, and ‘Other’ Deposits with RBI ( other deposits includes Deposits of quasi-government and other financial institutions including primary dealers, Balances in the accounts of foreign Central banks and Governments, Accounts of international agencies such as the International Monetary Fund, etc.).

- M1 (Narrow Money) – M1 is the sum of Currency with the Public, and Net Demand Deposits held by Commercial Banks.

- M2 – M2 is the sum of M1, and Savings Deposits with Post Office Savings Banks.

- M3 (Broad Money) – M3 is the sum of M1, and Net Time Deposits with the Banking System.

- M4 – M4 is the sum of M3, and Total Deposits with Post Office Savings Organizations (excluding National Savings Certificate)

Velocity of Money

- The velocity of money is a measurement of the rate at which money is exchanged in an economy.

- Velocity of Money = GDP/Total Money Supply

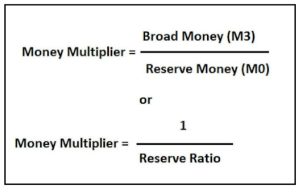

Money Multiplier

- Money multiplier is also known as the monetary multiplier.

- It is the amount of broad money that banks generate with each rupee of reserves or base money available with them. Here, reserves are the amount of deposits that the RBI requires banks to hold and not to lend.

- The money multiplier effect is seen in commercial banks as they accept deposits, and after keeping a certain amount as a reserve, they distribute the money as loans for injecting liquidity in the economy.

- The amount of money that should be kept by commercial banks in their reserve for withdrawal purposes by the customers is referred to as the reserve ratio.

- The higher the reserve ratio is, the less deposits will be available for lending, resulting in a smaller money multiplier and vice versa.

- Thus, higher the value money multiplier, higher will be liquidity in the market and Vice Versa.