Cooperative Banks

- Cooperative Banks refer to those financial institutions under the Banking System in India that operate on the principles of cooperation and mutual benefit for their members.

- Features:

- They belong to their members who are both the owners and customers of the bank.

- Cooperative Banks are named so because they have the cooperation of stakeholders as the motive.

- They operate on the principle of “one person, one vote” in decision-making and are managed on the basis of cooperation, self-help, and no profit no loss.

- Along with lending, these banks also accept deposits.

- Regulation:

- Under the Banking Regulation Act, 1949, and the Banking Laws (Application to Co-operative Societies) Act, 1965, the RBI is responsible for regulating banking aspects of these banks, such as capital adequacy, risk control, and lending norms.

- Registrar of Co-operative Societies (RCS) of respective State or Central Government are responsible for regulation of management-related aspects of these banks, such as incorporation, registration, management, audit, supersession of board of directors, and liquidation.

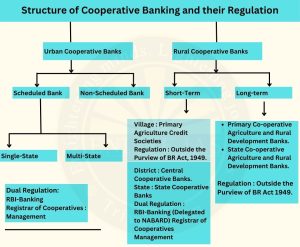

- Structure of Cooperative Banking and their Regulation

- Urban Cooperative Banks

- Scheduled Bank

- Single-State

- Multi-State

- Non-Scheduled Bank

- Scheduled Bank

- Rural Cooperative Banks

- Short-term

- Long-term

- Urban Cooperative Banks

Non Scheduled Banks

- Non Scheduled Banks in India are not listed under the Schedule II of the Reserve Bank of India Act, 1934. They can maintain the CRR by themselves. The characteristics of Non-Scheduled Banks are:

- Have to exhibit compliance to specific guidelines stipulated by RBI

- Reserve capital can be lesser than INR 5 Lakhs

- Interbank financial transactions and the cheque-clearing facility is not available.