Reserve Bank of India (RBI)

- It is the apex body in the Indian financial system.

- It acts as a regulatory body, responsible for the regulation of the Indian banking system as well as the control, issuing, and maintaining money supply in the Indian economy.

- The Reserve Bank of India (RBI), as established in 1935, was, initially, a privately owned entity and RBI was nationalised as per Reserve Bank of India (Transfer to Public Ownership) Act, 1948.

- Headquarters – Mumbai

Objectives

- To regulate the issue of banknotes

- To maintain reserves with a view to securing monetary stability and

- To operate the credit and currency system of the country to its advantage.

- To maintain price stability while keeping in mind the objective of growth.

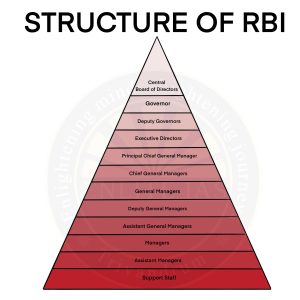

Structure

Functions

- Regulate Money Supply: The Reserve Bank of India (RBI) is responsible for the control, issuing, and maintaining supply of the Indian rupee. It also prints currency based on requirements.

- Managing Payment Systems: RBI manages the main payment system in the country and also aims to promote its economic development.

- Insuring Deposits: RBI has established the Deposit Insurance and Credit Guarantee Corporation for the purpose of providing insurance of deposits and guaranteeing all Indian banks credit facilities.

- Financial Supervision: RBI carries out consolidated supervision of the financial sector comprising commercial banks, financial institutions, and non-banking finance companies.

- Banker to the Government: RBI serves as a banker to the Government of India by maintaining its accounts, receiving payments into and making payments out of these accounts.

- Manager of Foreign Exchange: The Reserve Bank of India also facilitates external trade and payment and promotes orderly development and maintenance of the foreign exchange market in India.

- Banker of Banks: RBI plays the role of central bank where commercial banks are account holders and can deposit money. All scheduled banks maintain their banking accounts with RBI.

- Regulate Banking System: RBI plays the role of regulator and supervisor of the Indian banking system by ensuring financial stability & public confidence in the banking system.

- Developmental Contribution: RBI has to ensure a smooth flow of credit to developmental activities such as agriculture, micro and small enterprises (MSE), housing education etc.

- Represent India: The RBI acts as the representative of the Government in the International Monetary Fund and represents the membership of India.

Incomes of RBI

- Incomes from buying or selling foreign exchange.

- Incomes from Open Market operations (to prevent the rupee from appreciating).

- Incomes from government securities it holds.

- Returns from its foreign currency assets that are invested in the bonds of foreign central banks or top-rated securities.

- Returns from deposits with other central banks or the Bank for International Settlement (BIS).

- Returns from From lending to banks for very short tenures

- Management commission on handling the borrowings of State Governments and the Central Government.

Expenditures of RBI

- Expenditures on printing of currency notes

- Salary of its staff

- Giving commissions to banks for undertaking transactions on behalf of the government

- Giving commissions to primary dealers for underwriting some of these borrowings.