Taxation

- Taxation is a term for when an authority, mostly a government, imposes a financial obligation on its citizens/ residents/corporations/companies etc.

- It is a way of Income redistribution.

Associated Terms

- Tax Incidence: It is the one who actually pays tax. The true burden of a tax is given by incidence and not impact.

- Tax Impact: It is the entity on whom tax is imposed. The entity has the legal responsibility to pay taxes.

- Tax Shifting: When a tax’s incidence differs from the tax’s impact.

- Tax base: Volume of goods and services on which tax is imposed.

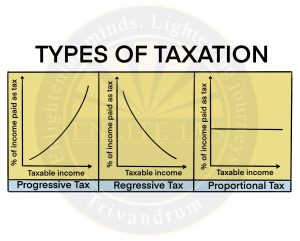

Types of Taxation

- Progressive Taxation

- Based on the taxpayer’s ability to pay.

- High income earners will pay more tax than low-income earners.

- Example – Income Tax

- Regressive Taxation

- A regressive tax is a tax applied uniformly, taking a larger Percentage of income from low-income earners than from high-income earners.

- It is in opposition to a progressive tax, which takes a larger percentage from high-income earners.

- Proportional Taxation

- The same percentage tax is levied on everyone regardless of income.

- Retrospective Taxation

- It allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from time before the date on which the law is passed.

- Countries use this route to correct any anomalies in their taxation policies that have, in the past, allowed companies to take advantage of such loopholes.