Goods and Service Tax (GST)

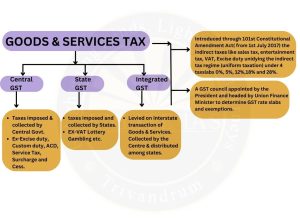

- Definition – It is a comprehensive tax levied on the manufacture, sale, and consumption of goods and services.

- Constitutional Backing – Introduced by the 101st Constitutional Amendment Act, on the lines of One Nation One Tax.

GST Compensation Cess

|